Contribution Margin Formula, Calculation, Example, Conclusion

The https://1investing.in/ can also use its contribution margin analysis to set sales commissions. If total fixed cost is $466,000, the selling price per unit is $8.00, and the variable cost per unit is $4.95, then the contribution margin per unit is $3.05. The break-even point in units is calculated as $466,000 divided by $3.05, which equals a breakeven point in units of 152,787 units. Assume that League Recreation, Inc, a sports equipment manufacturing company, has total annual sales and service revenue of $2,680,000 for all of its sports products.

Exponential Growth Expected for Facial Authentication System … – Digital Journal

Exponential Growth Expected for Facial Authentication System ….

Posted: Fri, 14 Apr 2023 13:18:07 GMT [source]

Patrons will shop, bag the purchased items, leave the store, and be billed based on what they put in their bags. Along with managing the purchasing process, inventory is maintained by sensors that let managers know when they need to restock an item. GrowthForce accounting services provided through an alliance with SK CPA, PLLC.

AccountingTools

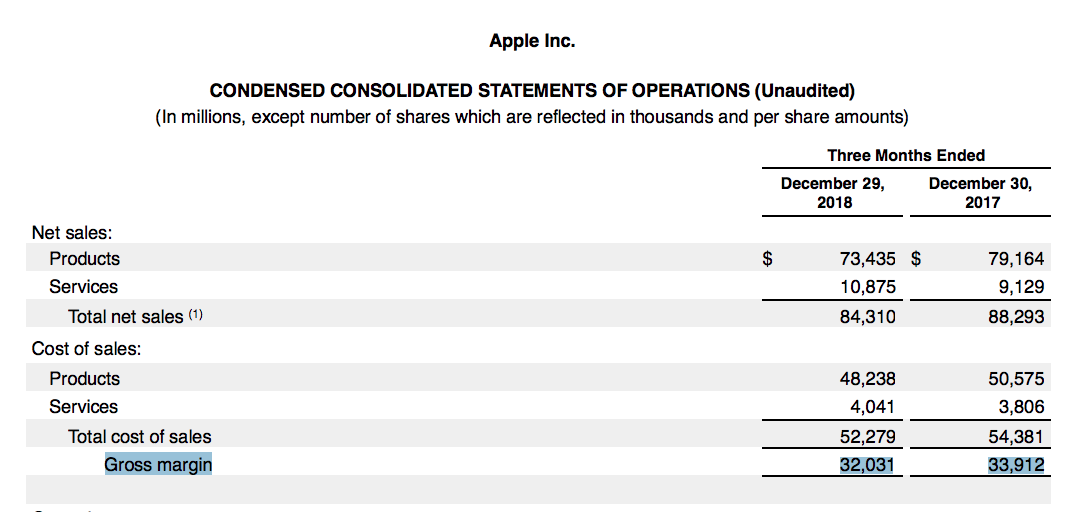

The ratio is also useful for determining the profits that will arise from various sales levels . Contribution margin is a business’s sales revenue less its variable costs. The resulting contribution dollars can be used to cover fixed costs , and once those are covered, any excess is considered earnings. Contribution margin (presented as a % or in absolute dollars) can be presented as the total amount, amount for each product line, amount per unit, or as a ratio or percentage of net sales. The contribution margin is different from the gross profit margin, the difference between sales revenue and the cost of goods sold.

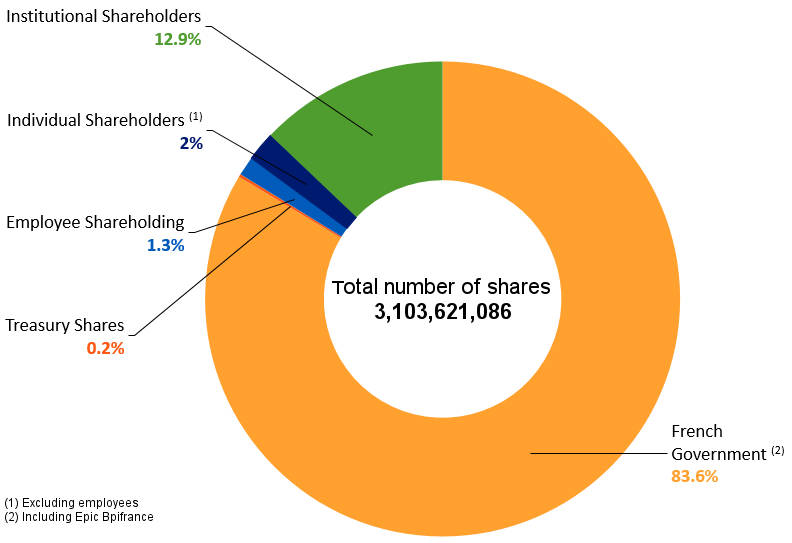

Sodexo announces solid H1 Fiscal 2023 results and plan to spin-off … – InvestorsObserver

Sodexo announces solid H1 Fiscal 2023 results and plan to spin-off ….

Posted: Wed, 05 Apr 2023 05:01:59 GMT [source]

The GoCardless content team comprises a group of subject-matter experts in multiple fields from across GoCardless. The authors and reviewers work in the sales, marketing, legal, and finance departments. All have in-depth knowledge and experience in various aspects of payment scheme technology and the operating rules applicable to each.

Target Costing Situations

On the other hand, the gross margin metric is a profitability measure that is inclusive of all products and services offered by the company. To go through a simple example, let’s say there’s an e-commerce company selling t-shirts for $25.00 with variable costs of $10.00 per unit. Contribution margin can be used to calculate how much of every dollar in sales is available to cover fixed expenses and contribute to profit. Video from Investopedia reviewing the concept of contribution margin to learn more. Keep in mind that contribution margin per sale first contributes to meeting fixed costs and then to profit. Materials, transportation, and marketing fees are typical examples of variable costs.

Moreover, the statement indicates that perhaps prices for line A and line B products are too low. This is information that can’t be gleaned from the regular income statements that an accountant routinely draws up each period. To find the number of units required to break even, simply divide the firm’s total fixed costs by the unit contribution margin. This lets managers and business owners know the level of sales required to cover all costs and begin earning a profit. Contribution margin is the portion of a product’s revenue that exceeds the variable cost of producing that product and generating that revenue.

Contribution Margin And What It Can Tell You

Find out the contribution, contribution margin per unit, and contribution ratio. To find the amount of units required to be sold in order to break even, we simply divide the total fixed costs by the unit contribution margin. A business has a negative contribution margin when variable expenses are more than net sales revenue. If the contribution margin for a product is negative, management should make a decision to discontinue a product or keep selling the product for strategic reasons.

Workable Strategic Report on College Preparation Market by … – Digital Journal

Workable Strategic Report on College Preparation Market by ….

Posted: Fri, 14 Apr 2023 13:18:07 GMT [source]

When making judgments on cost analysis or profitability measurements, certain cost components shouldn’t be taken into account. When sales have exceeded the break-even point, a larger contribution margin will mean greater increases in profits for a company. Calculating the contribution margin for each product is one solution to business and accounting problems arising from not doing enough financial analysis. Calculating your contribution margin helps you find valuable business solutions through decision-support analysis.

The Contribution Margin represents the revenue from a product minus direct variable costs, which results in the incremental profit earned on each unit of product sold. The long-term aim is to achieve a positive contribution margin to support fixed overheads and generate a profit. Fast-growth e-commerce businesses often operate at very low or even negative contribution margins in order to acquire customers and build market share fast. The addition of $1 per item of variable cost lowered the contribution margin ratio by a whopping 10%. You can see how much costs can affect profits for a company, and why it is important to keep costs low. You will recall that the per-unit contribution margin was $80 for a Leung Rosella birdbath.

Consider a situation where a business has a pen-making machine that can create both ink pens and ball-point pens, but management must decide which to produce. Profits will equal the number of units sold in excess of 3,000 units multiplied by the unit contribution margin. Profit will only be earned if fixed costs are lower than the contribution. The operating margin is found by dividing net operating income by total revenue.

It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated. For example, suppose your company manufactures and sells 1 million bottles of a drink, each at $1.50 with $1 in variable costs. Sales equals 1 million bottles multiplied by $1.50 each, which comes to $1.5 million. Total variable cost equals $1 per bottle multiplied by the 1 million bottles, which comes to $1 million.

- When you arrive, click a button on the app or in the text message you received letting you know your groceries are ready – and someone will bring out your order and place it directly in your boot.

- Expressing the contribution margin as a percentage is called the contribution margin ratio.

- Contribution Marginmeans an amount equal to 25% of the revenues generated from an SES Contract.

- Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold.

- Calculate contribution margin for the overall business, for each product, and as a contribution margin ratio.

- We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit.

The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good. This is one of several metrics that companies and investors use to make data-driven decisions about their business. As with other figures, it is important to consider contribution margins in relation to other metrics rather than in isolation. A key characteristic of the contribution margin is that it remains fixed on a per unit basis irrespective of the number of units manufactured or sold. On the other hand, the net profit per unit may increase/decrease non-linearly with the number of units sold as it includes the fixed costs.

Here we discuss the formula to calculate Contribution Margin and practical examples and excel templates. You may also look at the following articles to enhance your financial skills. There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs. However, a general rule of thumb is that a Contribution Margin above 20% is considered good, while anything below 10% is considered to be relatively low. Thus, at the 5,000 unit level, there is a profit of $20,000 (2,000 units above break-even point x $10).

- Contribution margin is the variable expenses plus some part of fixed costs which is covered.

- Do these labour-saving processes change the cost structure for the company?

- It shows the extra revenue made for each product or unit sold after the variable costs have been subtracted.

- It’s likely that a division leader at GE is managing a portfolio of 70-plus products and has to constantly recalculate where to allocate resources.

Management can see how much income will be contributed to covering fixed costs. Often times, fixed costs aren’t easily traced back to individual products in the production line. The same auto manufacturer might not be able to trace utilities and insurance back to a specific product being produced.

Another major innovation affecting public accounting costs is the development of driverless cars and trucks , which will have a major impact on the number of taxi and truck drivers in the future . Do these labor-saving processes change the cost structure for the company? This ratio indicates the percentage of each sales dollar that is available to cover a company’s fixed expenses and profit. It’s also important to understand the difference between the gross margin and the contribution margin. Put simply, gross margin measures the amount of revenue that’s left after you subtract all the costs that are directly linked to production. So, when it comes to contribution margin vs. gross margin, what’s the difference?