How To Trade The Three Black Crows Pattern

Contents:

It means for every $100 you risk on a trade with the Three Black Crows pattern you lose $14.1 on average. 1A three soldiers reversal pattern indicating a shift in power from the sellers to the buyers. Also, the second candlestick should close near its high, leaving a small or non-existent upper wick. The first of the “three soldiers” is called the reversal candle. It either ends the downtrend or implies that the period of consolidation that followed the downtrend is over. After selecting on it, you will get a list of stocks in which the “Three Black Crows” pattern is formed.

This trading action will result in a very short or nonexistent shadow. Traders often interpret this downward pressure sustained over three sessions to be the start of a bearish downtrend. Three Black Crows got its name from its resemblance to three crows looking down from their perch in a tree. This signal, occurring after a strong uptrend, indicates the crows looking down or lower prices are to come.

What is the Three Black Crows Pattern?

You need to find an uptrend and wait for a big red candle to appear. This candle should be at least half of the previous one, marking that sellers have entered the game. As you can see, there are more cons than pros in trading the 3BC pattern.

However, you can implement this pattern in your trading strategy, making it more reliable and less risky if you want to. However, reading about the pattern’s cons would be best to understand how to seek reversals. The second and third candles must be approximately the same size, to confirm that the bears are firmly in control.

Mat Hold Pattern Definition and Example – Investopedia

Mat Hold Pattern Definition and Example.

Posted: Sat, 25 Mar 2017 20:00:35 GMT [source]

Now, we hope that you are familiar with some practical techniques for working with the Three Black Crows. It means for every $100 you risk on a trade with the Identical Three Crows pattern you lose $7.8 on average. Stop-loss should be fixed at the high price of the third candle formed in the pattern. In order to use Three Black Crows Candlestick Pattern for trading purposes, one should also pay attention to other factors like volume of trades, Relative Strength Index , etc.

quiz: Patterns: three soldiers and crows

To be valid, you must have three consecutive bearish long candlesticks. This candlestick pattern has a counterpart known as the Three white soldiers, whose attributes help identify a bullish reversal or market upswing. Next, you need to analyze the instrument and understand the market structure that prevails in it. These questions will help you to understand what is the best thing you can do after the pattern is ready. In our scenario, we have chosen to trade the US500 index, a trendy market with small and fast pullbacks (3-5 trading sessions). The example above briefly explained the classical way of trading the three black crows pattern.

From that, you can assume, a strong downtrend has just started. When more than one force acts on the Three Black Crows pattern, such as a strong negative sentiment, there’s a high chance it will result in a reversal. Though some traders do find success using these patterns on intraday charts, they work best with daily charts for longer-term traders. When markets move upwards with strong momentum for extended periods, it’s only natural for bulls to eventually loosen their grip on the market, perhaps selling off to rake in some profits. The Three Black Crows pattern tells traders that there’s a bearish trend on the horizon, pushing them to take short positions.

There are also several references to the three crows in the German folklore. A number of these were included in the collection of stories by the Grimm brothers, Jacob and Wilhelm. There is, for instance, the legend of Faithful John, which told of three crows who warned faithful John about a series of misfortunes that would befall his king.

A Guide to Risk Reward Ratio

Each of these candles should close very near the low for the day. This pattern, as will be seen, is the opposite of the Three White Soldiers. To identify triple Japanese candlestick patterns, you need to look for specific formations that consist of three candlesticks in total.

Bitcoin Price Monthly Chart At Risk Of Three Black Crows Reversal – NewsBTC

Bitcoin Price Monthly Chart At Risk Of Three Black Crows Reversal.

Posted: Sat, 10 Oct 2020 12:52:53 GMT [source]

While it is considered a bullish signal, its appearance isn’t as significant as one that appears after a strong uptrend. The Three White Soldiers pattern is formed when three long bullish candles follow a DOWNTREND, signaling a reversal has occurred. Unlock our free video lessons and you will learn the exact chart patterns you need to know to find opportunities in the markets. HowToTrade.com helps traders of all levels learn how to trade the financial markets. Watch this video to learn how to identify and trade the 3 black crows pattern with real-time examples. Of course, with markets being what they are that could also mean a large number of small bullish traders running into a smaller group of large-volume bearish trades.

Limitations of the Three Black Crows Pattern

It consists of three consecutive bearish candles that form within an uptrend. If not, read on to learn more about how this formation can help you profit from forex volatility. There’s no pattern in technical analysis that is 100% reliable. However, the three black crows pattern is reliable enough when used with a market structure analysis and common sense. A bearish harami pattern is a small red candle inside a bigger green candle.

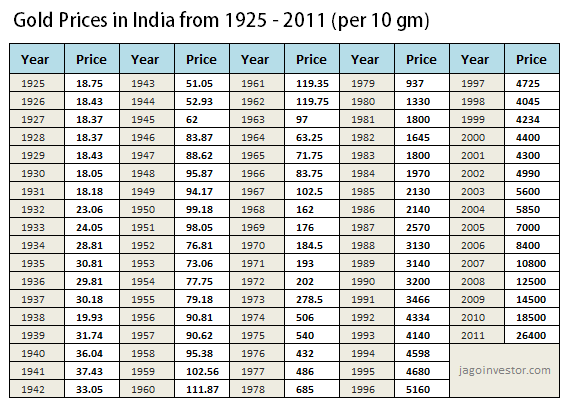

For example, gold loves three black crows and usually moves lower after the pattern is finished. In trading, we can rely on a bunch of different entry signals. While some can be calculated and defined with a strict mathematical formula, others are not that simple.

As you know, the most popular chart type is Japanese candlesticks. They are easy to read, informative, and used by most traders to predict future market movements. At a certain point, traders came up with the idea of identifying candlestick patterns. They usually look like a series of candlesticks, after which the price moves in a particular direction. Three black crows is one of the patterns used by traders to seek reversal candlestick patterns on a chart. Three black crows show a bearish candlestick pattern that predicts the reversal of an uptrend.

Statistics to prove if the Three Black Crows pattern really works

Each of those candles must open below the previous day’s open. The Three Black Crows usually indicate a weakness in an established uptrend and the potential emergence of a downtrend. Now, suppose we want to make sure that the market has risen significantly to the upside before we enter a transaction when trading the three black crows. The mean-reverting characteristics of equities, such as stocks, are seen in the second strategy example. To put it simply, mean reversion is the tendency of a market to move back once it has moved too far in one direction.

The most extended candle was on the third day, even though the candles did not gradually get longer. All the bodies must have real and identical bodies with exactly the same size. We analysed 4120 markets for the last 59 years and we found occurrences of the Identical Three Crows pattern.

For this pattern, place the stop-loss above the first candle and close the entire position when the price action gets to a significant area of support. As well the pattern should come up at or close to a chart top so that the first bar forms a recent high. Remember that three black crows can form in either bearish or bullish trends. In a bearish trend the pattern often appears in short upswings or bearish rallies.

- Each candle should open below the previous day’s open, ideally in the middle price range of that previous day.

- However, the price is pushed lower throughout the next sessions.

- The bears are only said to be in control when the second and third candles are approximately the same size.

Eventually the closing levels are low as a result of bears’ pressure. Volume is also another factor that helps to get an insight into the market. The identification of the identical three crows candlestick pattern is a bit complex because it has three candlesticks.

These candlestick formations help traders determine how the price is likely to behave next. As the three crows pattern makes the prices to fall, traders should be cautioned of the oversold conditions that may lead to consolidation before a further move down of the prices. The first candlestick of this pattern should be long bodied bearish candlestick and must be formed as the continuation of the ongoing uptrend.

The pattern unfolds on the markets with high volatility, such as after the release of important news; a strong trend rises only to suddenly collapse. It is, however, possible for this pattern to be too aggressive. Candles that are excessively large may indicate the bears have overstretched themselves, pushing the security into oversold territory. In this situation, the bears should be wary that the reversal does not become a retracement as the bulls take advantage of their depleted momentum. Traders use it alongside other technical indicators such as the relative strength index . An overextended body within the pattern might mean that the price has advanced too quickly and the market could be overbought or oversold.

There can be 8 possible combinations of three crows patterns in this pattern. Also, the third-day candle should never break the high price of the second day’s candle. Also, the second-day candle should not break the high price of the first day’s candle.