Depreciation Tax Shield Depreciation Tax Shield in Capital Budgeting

Contents:

E put together this article to help cover what you need to know. Keep reading to learn all about a tax shield, how to calculate it depending on your effective tax rate, and a few examples. You have a little bit of flexibility with a tax shield since you have an opportunity to reduce taxable income for a specific tax year.

Trump’s tax manoeuvres do not change his billionaire status – Al Jazeera English

Trump’s tax manoeuvres do not change his billionaire status.

Posted: Tue, 29 Sep 2020 07:00:00 GMT [source]

It is inversely related with the tax payments higher the depreciation tax shield lower will be the depreciation. Depreciation is the non-cash expense hence with the proper planning the net operating cash flows can be increased and better management of funds are to be done. In capital budgeting also it is one of the useful tools to decide whether to purchase the asset or to lease the asset. Tax payments can be better managed with the depreciation tax shield. Companies using accelerated depreciation methods are able to save more taxes due to higher value of tax shield.

$119 Budget Car Rental Martha

Discount the project’s levered CFFA by the furniture manufacturing firms’ 30% WACC after tax. Discount the project’s levered CFFA by the company’s 20% WACC after tax. Discount the project’s unlevered CFFA by the company’s 20% WACC after tax. Discount the project’s unlevered CFFA by the furniture manufacturing firms’ 30% WACC after tax.

This is because the net effect of losing a tax shield is losing the value of the tax shield, but gaining back the original expense as income. Since the interest expense on debt is tax-deductible it makes debt funding that much cheaper. Now that you know how to use them, don’t spend all your time calculating tax shields. Most require significant expenses that need to be considered along with other factors. If you use good tax software, it will automatically prompt you to use the best deductions and strategies. An interest tax shield saves you money by using debt instead of further investment.

https://www.travelocity.com/Car-Rentals-In-Marthas-Vineyard.d5854797.Car-Rental-Guide

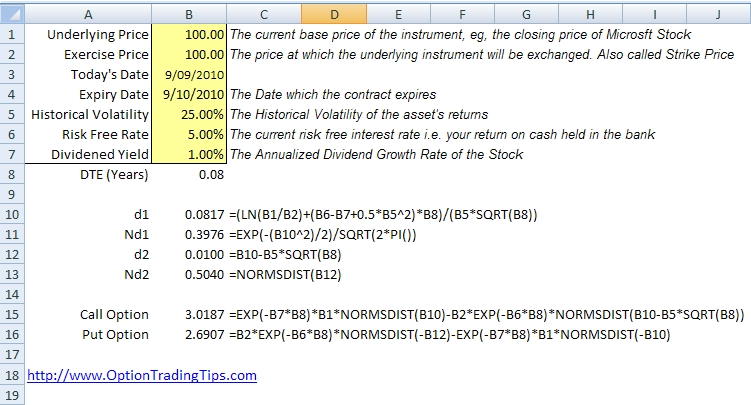

A https://1investing.in/ shield is a legal way for individual taxpayers and corporations to try and reduce their taxable income. The total value of a tax shield is going to depend on the tax rate of an individual or corporation and their tax-deductible expenses. The formula for calculating a depreciation tax shield is easy. All you need to do is multiply depreciation expense for tax purposes and multiply by the effective income tax rate.

Dream of Owning a Plane? This Tax Break Can Help (Published 2019) – The New York Times

Dream of Owning a Plane? This Tax Break Can Help (Published .

Posted: Fri, 05 Apr 2019 07:00:00 GMT [source]

For example, if a business is analysing whether to lease or purchase a building. Therefore, for such choices, the business has to keep in mind the tax benefits it would gain by taking a mortgage for the same which is a part of the tax shield approach. Companies also consider it while deciding an optimal capital structure. Referring to a mix of debt and equity funds used for the operations by the company is capital structure. Therefore, since interest on debt is tax-deductible, it makes mortgage a cheaper finance option. The effects of the tax shield approach must be used in cash flow analyses since the amount of cash paid is impacted.

Lower taxes forever

The higher your depreciation expense, the higher your tax shield. Depreciation is an accounting method used to allocate costs to tangible physical assets during the course of their useful life. The current levered asset value including tax shields is $603.839k. The debt-to-equity ratio will be kept constant throughout the life of the project. Unrestricted negative gearing is allowed in Australia, New Zealand and Japan.

Some include the annual interest tax shield in the cash flow and some do not. The company’s expected levered firm free cash flow will be higher due to tax shields. The firm’s share price will increase due to the higher value of tax shields.

The result equals the depreciation tax shield as the company will pay lower taxes. In general, a tax shield is anything that reduces the taxable income for personal taxation or corporate taxation. Depreciation is considered a tax shield because depreciation expense reduces the company’s taxable income. When a company purchased a tangible asset, they are able to depreciation the cost of the asset over the useful life. Each year, this results in some amount of depreciation expense for tax purposes.

How do Bonds Function as a Tax Shield?

The key word here is “reasonable” — if you pay your 15-year-old son $350,000 per year to shred documents on Saturday, the IRS won’t be happy. Another benefit of this strategy is that you won’t have to pay FICA taxes on the child until they turn 18, or FUTA until they turn 21. The positive NPV of $50,112 shows the return of this proposal is above the company’s required rate of return of 10 percent. What’s interesting here is that the $20,000 yearly expense that is allocated to the asset is a non-cash expense (the company did not have to disburse $20,000 for that asset every year). All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

If your out-of-pocket what is an enrolled agent costs were more than 7.5% of your adjusted gross income last year, you’ll gain this tax shield. This figure means all medical costs over $3,750 are deductible. You had $10,000 of medical costs last year, meaning you’ll receive a $6,250 deduction for medical expenses. Optimizing your return is often one of the most important things you can do during tax season. One way to make the most of your tax situation is by using deductions to lower your tax burden.

The intuition here is that the company has an $800,000 reduction in taxable income since the interest expense is deductible. As for the taxes owed, we’ll multiply EBT by our 20% tax rate assumption, and net income is equal to EBT subtracted by the tax. D&A is embedded within a company’s cost of goods sold and operating expenses, so the recommended source to find the total value is the cash flow statement .

Straight-Line vs. Accelerated Depreciation – Cash Flow Impact

The firm’s debt and shares are fairly priced and the shares are repurchased at the market price, not at a premium. Therefore firms should try to pay off all of their debt so that they are financed by equity only. This is not much of a problem when the Bu and Ku is established from a comparison set of companies. The remaining circular reference from re-levering the beta can be easily resolved. If an investor pays $1,000 of capital, at the end of the year, he will have ($1,000 return of capital, $100 income and –$20 tax) $1,080. Deductions for mortgage interest, charity donations, medical costs, and depreciation are a few examples.

In a business with consistent growth, it makes sense to defer taxes because, when they come due, revenue has grown, and the tax payment will make a lower impact, relatively speaking. AInitial investment purchase price does not directly affect net income and therefore is not adjusted for income taxes. Figure 8.7 “NPV Calculation with Income Taxes for Scientific Products, Inc.” provides a detailed example of how companies adjust for income taxes when evaluating long-term investments. Examine Figure 8.7 “NPV Calculation with Income Taxes for Scientific Products, Inc.” carefully, including the footnotes, as we explain each of these items.

- Under U.S. GAAP, depreciation reduces the book value of a company’s property, plant, and equipment (PP&E) over its estimated useful life.

- A tax shield refers to an allowable deduction on taxable income, which leads to a reduction in taxes owed to the government.

- If you deliberately claim specific tax credits that you’re not eligible for, then you are committing tax fraud.

- A tax shield formula determines the future tax saving attribute of tax by showcasing an organisation’s present value.

Determine the total depreciation value that can be considered in the deduction. Calculate $500,000 of investment to be depreciated over 6 years using Balance Depreciation method and declining balance rate of 180%. Although the overall amount of depreciation remains the same using the entire life usage of the asset. Tax evasion occurs when people intentionally fail to report their revenue or income to the proper taxing authority, such as the Internal Revenue Service . Plays a vital role in capital budgeting for the selection of the appropriate project. As a cost of borrowing, the borrower must make Interest payments for the benefit of borrowing.

Trump’s tax returns reveal how he manipulated laws to minimise yearly payments – The Independent

Trump’s tax returns reveal how he manipulated laws to minimise yearly payments.

Posted: Fri, 30 Dec 2022 08:00:00 GMT [source]

The nominal WACC before tax is 10% pa and is not expected to change. The nominal WACC after tax is 9.5% pa and is not expected to change. The future value of the actual cash payments of the bond over the year, grown to the end of the year, and grown by the bond’s yield to maturity.

Moreover, a few covenants demand the company to maintain various ratios such as debt coverage ratio or debt-equity ratio. Interest expenses on certain debts can be tax-deductible, which can make the entire process of debt funding much easier and cheaper for a business. This works in the opposite way to dividend payments, which are not tax-deductible.