New How The Stock Market Works

Contents

To get your class started with our free stock market game, just register now and then follow the links to create your own contest. “Chase Private Client” is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking℠ account. Whether you choose to work with an advisor and develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. JPMorgan Chase & Co., its affiliates, and employees do not provide tax, legal or accounting advice. Information presented on these webpages is not intended to provide, and should not be relied on for tax, legal and accounting advice.

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Stock Index — An index gathers data from a variety of industries and helps investors calculate performance. The three most popular indexes in the US are the Dow Jones Industrial Average, Nasdaq Composite, and the S&P 500.

Just like the housing market, the stock market involves buyers, sellers and prices that go up and down. It’s an abstract term that refers to the way investors can buy into public companies that are listed on stock exchanges. A private company “goes public” through an initial public offering . That signals that it will begin offering stock shares to the public. The secondary purpose the stock market serves is to give investors – those who purchase stocks – the opportunity to share in the profits of publicly-traded companies.

Jody’s doctor recommended she purchase assistive equipment to help her work comfortably at her desk without aggravating her condition. These modifications helped ensure she could return to work safely, without hindering her recovery. To our health care providers, first responders and everyone selflessly setting aside their own fears and concerns to help others during this time — thank you hardly seems enough.

What is the stock market in simple terms?

Investing in the stock market does come with risks, but with the right investment strategies, it can be done safely with minimal risk of long-term losses. Day trading, which requires rapidly buying and selling stocks based on price swings, is extremely risky. Conversely, investing in the stock market for the long-term has proven to be an excellent way to build wealth over time. Stock markets represent the heartbeat of the market, and experts often use stock prices as a barometer of economic health. But the importance of stock markets goes beyond mere speculation. By allowing companies to sell their shares to thousands or millions of retail investors, stock markets also represent an important source of capital for public companies.

- But investors who are aware of the factors that affect market price are more likely to make sound investment decisions.

- Alternatives Buy fractional shares of fine art, collectibles, and more.

- These shares tend to be riskier since they list companies that fail to meet the more strict listing criteria of bigger exchanges.

- If you’re investing for the short term, you risk not having your money when you need it.

- These risks include, but are not limited to, lower liquidity, higher volatility and wider spreads.

Those https://en.forexbrokerslist.site/ funds have to be invested somewhere, and you don’t have to look far to find the best place to start investing through the stock market. It’s the 401, 403 or other workplace retirement plan you get through your employer! Small-, mid- and large-cap stocks are ways to categorize market capitalization, which is the total value of all the shares of a company’s stock.

For example, the SEC monitors large market participants, like banks and funds, to ensure honesty and prevent them from manipulating the markets unfairly. A famous stock market crash happened in the United States in October 1929. Over several days panicked investors sold so many shares of stock that the whole market collapsed. Farmers could not sell their crops, banks and businesses closed, and wages fell to very low levels.

It might surprise you that in the National Study of Millionaires, no millionaire said that single-stock investing helped them reach their net worth. They understand that betting your retirement future on a handful of company stocks is more like gambling at a casino in Vegas than actually investing. If those single stocks you picked go down, your retirement future goes down with it. Investing in the stock market can be exciting, and Public’s suite of social tools and professional guidance can help you learn how to navigate the market and decide on an investment strategy. Find the stocks you want to buy on Public and specify the number of shares.

An exchange listing means ready liquidity for shares held by the company’s shareholders. Owning stock means that a shareholder owns a slice of the company equal to the number of shares held as a proportion of the company’s total outstanding shares. You tell your broker what stock you want to buy and how many shares you want. Taking it a step further, it’s important to consider how it’s almost always possible to buy or sell a stock you own. Modulating the temperature of the open-air space stretching nearly 100 feet above the Trading Floor required the services of engineer Alfred Wolff.

Neither Stock-Trak nor any of its independent data providers are liable for incomplete information, delays, or any actions taken in reliance on information contained herein. By accessing the How The Market Works site, you agree not to redistribute the information found within and you agree to the Privacy Policy and Terms & Conditions. Easily research, trade and manage your investments online all conveniently on Chase.com and on the Chase Mobile app®.

How Stock Markets Work

If https://topforexnews.org/ actively buying and selling stocks, there’s a good chance you’ll get it wrong at some point, buying or selling at the wrong time, resulting in a loss. The key to investing safely is to stay invested — through the ups and the downs — in low-cost index funds that track the whole market, so that your returns might mirror the historical average. Supply and demand help determine the price for each security, or the levels at which stock market participants — investors and traders — are willing to buy or sell. This process is called price discovery, and it’s fundamental to how the market works.

Analysts use indices to track the performance of a specific group of stocks on an exchange. For example, the FTSE 100 represents the performance of the top 100 companies on the LSE by market capitalisation. Buy a stock fund based on an index, such as the S&P 500, and hold it to capture the index’s long-term return. However, its return can vary markedly, from down 30 percent in one year to up 30 percent in another.

Trying to https://forex-trend.net/ the market to buy and sell at the exact right moment is virtually impossible. Stocks and stock mutual funds are ideal for a long time horizon — like retirement — but unsuitable for a short-term investment . With a short-term investment and a hard deadline, there’s a greater chance you’ll need that money back before the market has had time to recover losses. IRA. Both accounts can be opened at an online broker, through which you can buy and sell investments. The broker acts as the middleman between you and the stock exchanges.

Stock Market Supply and Demand

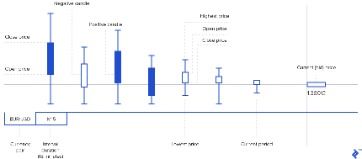

If more investors are buying the stock than selling it, the demand for that stock goes up and the value tends to increase. This often results when investors believe the value of the company’s stock will increase as a result of strong financial performance or other market factors. Conversely, when investors believe a stock will perform poorly, they’ll sell it, which floods the market with supply and decreases demand. Public Trends shows stock performance over time, helping investors understand long-term movements in stock prices. You can opt for individual stocks and bonds or mutual funds, index funds and exchange-traded funds that contain hundreds of individual securities.

In 1624, the Dutch founded New Amsterdam on the southern end of Manhattan and built a stockade from which the street derives its name; running east from what is now Broadway downhill to the East River. The Compromise of 1790 cemented Wall Street’s role as the nation’s financial capital. The agreement allowed Alexander Hamilton, the United States first Secretary of the Treasury, to implement his fiscal policy of paying Revolutionary War debt using federally issued bonds.

For example, if you own a broadly diversified fund based on the S&P 500, you’ll own stocks in hundreds of companies across many different industries. But you could also buy a narrowly diversified fund focused on one or two industries. The Dow Jones Industrial Average is one of the three most popular stock market indexes in the US. When an investor buys stock, they are hoping that the stock will go up in value. The ultimate goal of an investor is to sell the stock for a profit.

Share price experiences less volatility compared to common stock. For most of us, working for the rest of our lives isn’t feasible, so we need to create passive income in order to retire. The sooner you invest, the more wealth you can build and passive income you can create—plus the earlier you can retire. Better than bonds, better than gold, and even better than real estate. This can be an incredible way to build wealth not only for you but also for the generations to come.

These are the earliest examples of limited liability companies , and many held together only long enough for one voyage. If you sell stocks for more than you paid, you can expect to be taxed on those gains. These are regular payments certain companies make to shareholders to distribute some of its profits.

In a nutshell, the stock market is where investors go to buy and sell stocks, which are basically small pieces of ownership in a company. The stock market is made up of many different stock exchanges where companies go to sell their stock and investors come together to trade stocks with each other. Robo-advisors use algorithms to invest in the stock market for you. You’ll likely fill out an online questionnaire regarding your income, assets, risk tolerance, investment timeline, financial goals and more. The platform then automatically makes investments on your behalf, usually in funds that hold a variety of assets. However, you probably won’t be able to select your investments or buy individual stocks.

The crisis and the way we collectively respond to it will define a generation. That’s proving true in businesses and homes across the community, the country and around the world. Use this calculator to estimate how much money you’ll need in retirement. Annuities Look into an annuity for safety, tax deferral and choice as you plan and save for retirement. Disability insurance can help pay the bills if a serious illness or injury keeps you from working. Investors may be able to access financial information more easily than if you invest directly overseas.

People can’t just walk up to the New York Stock Exchange on Wall Street and buy or sell shares, though. When a stock is actually purchased or sold by the average person, it is done so through a brokerage. A financial market is a place where firms and individuals enter into contracts to sell or buy a specific product such as a stock, bond, or futures contract. Buyers seek to buy at the lowest available price and sellers seek to sell at the highest available price.