How to Calculate EBITDA with Calculator

Content

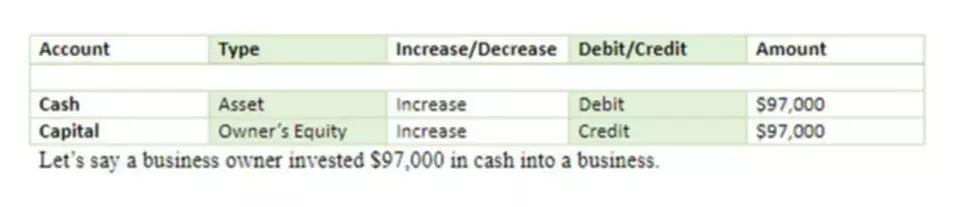

For those wanting to calculate EBITDA by hand, there are two methods you can employ. All you’ll need to get started are your financial statements, specifically the income statement and cash flow statement, for the period https://quickbooks-payroll.org/ you’d like to review. Many companies may choose to calculate EBITDA monthly or quarterly to review performance. Those anticipating a sale may also need to calculate it on an ad hoc basis for potential buyers.

- EBITDA strips out the cost of the company’s asset base as well as its financing costs and tax liability.

- Thanks to QuickBooks’ crucial accounting features, the following KPIs can be easily calculated to ensure the reliability of your restaurant’s financial success.

- Add the depreciation and amortization expenses together to calculate the company’s non-cash operating expenses.

- Another factor is the number of assets needed for a particular company to operate.

- Looking forward at 2023 fiscal year earnings per share estimates, the story improves slightly with the stock trading at roughly 48 times estimated earnings.

- The dashboard shows a quick overview of the company’s invoices, expenses, profit and loss, sales, and accounts receivable.

For this company, EBITDA is higher than EBIT, so the company might prefer to highlight EBITDA as a performance metric. EBIT and quickbooks ebitda EBITDA are both measures of a business’s profitability. Interest is a reflection of how a business finances its activities.

Explore metrics

Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends. As inflation rises, we are increasingly encouraging customers to proactively cut unneeded expenses and focus on cash. Below are six things that you can proactively do to manage your cash. These apply regardless if we’re heading into an economic downturn or the economy is roaring. Also known as a conversion cap, a valuation cap is designed to set the threshold for the convertible note so that an investor can own a larger stake of your company. It can help convince investors to pursue your company at its early stages and steer it toward success.

Our NetSuite certified consultants work with each client to implement software to improve, record, and report on business performance. Our typical clients have outgrown Quickbooks and need help assessing an ERP system and migrating data from one system into another. Pinewood gives our clients NetSuite support to set up, optimize, and maintain their NetSuite ERP to maximize efficiency and EBITDA. The formula is essentially the subtraction of fixed costs from the restaurant’s gross profit. QuickBooks’s P&L report can be run monthly, quarterly, or annually to get a snapshot of your restaurant’s overall net income, expenses, and profitability.

What Does a Low EBIT but High EBITDA Indicate?

So the income and expense from the machine sale are posted to non-operating income. So the income and expense from the machine sale posts to non-operating income. Depreciation expenses post to recognize the decline in value of capital expenditures, including vehicles, machinery, and equipment.

Knowing this allows you to analyze your earnings without considering interest, taxes, and other variables so you can compare your operations and success to other businesses in your industry. Let’s dive deeper into how to calculate EBITDA and how to use this figure for decision making. So far, we’ve focused largely on the pros of EBITDA, which are that it allows businesses with different capital structures to be compared based roughly on operational performance.

Pinewood’s NetSuite ERP Solutions

It’s for this reason that private equity groups and investors pay close attention to this metric, as well as companies who are anticipating a sale in their future. It allows them to gauge the company’s operating performance, quickly compare to others in the industry, and get a feel for a company’s valuation. A P&L report is run better on an accrual basis than cash flow because it includes revenue and expenses that you’re either owed or owe, regardless of whether cash has exchanged hands.

Interest and taxes are real business expenses that drain cash from a company. And although depreciation and amortization are accounting techniques rather than real cash outlays, many assets really do lose their value over time and eventually will have to be replaced. Thus, EBITDA may give the impression that a company’s expenses are lower than they really are, and therefore that it is more profitable than it really is. So what are the benefits in using EBITDA and what are the drawbacks? Because EBITDA isn’t defined or governed by GAAP, it can be calculated in slightly different ways by companies.

Operating profit shows only total revenue less COGS and operating expenses. This means that tax and interest expenses are already excluded. Reviewing the income statement, or profit and loss statement, locate your operating profit. Operating profit shows revenue less cost of goods sold and operating expenses. Unlike net income, or the “bottom line” of the P&L statement, it does not take into account tax or interest expenses.

Intuit: Credit Karma And Mailchimp Integration A Game Changer (NASDAQ:INTU) – Seeking Alpha

Intuit: Credit Karma And Mailchimp Integration A Game Changer (NASDAQ:INTU).

Posted: Sun, 26 Jun 2022 07:00:00 GMT [source]

I knew what it was, but not exactly why they were focused on that as the metric. Having read this article, I understand better why it’s an important metric.” We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

Some believe that those expenses should be included in the overall financial picture of your company. It is worth noting also that EBITDA, alone, should not be used to evaluate your company’s financial health but can be used in combination with other indicators, such as cash flow. Taxes are not included because they are affected by factors other than your company’s profitability.

- The formula is essentially the subtraction of fixed costs from the restaurant’s gross profit.

- Don’t use EBITDA as the sole measure of your company’s financial health.

- These will all reflect positively in terms of your EBITDA as they are simply good business practices.

- Also, QuickBooks allows you to set up a purchase order and will send it to the vendor, so required items are reordered on time.

- It can be extremely misleading if it is taken out of context, which it often is.

- This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia.

- Understand the meaning and differences of various terms found on a profit and loss statement.